Mill Hill Branch

7 Thornfield Parade

Holders Hill Road

Mill Hill, London

NW7 1LN

Buying a new property can seem daunting, but with the right information, the process can become much more straightforward. Our step-by-step guide to buying a new property covers the basics so you can start your journey towards your new home.

Given the costs involved in buying a new home, the first thing you need to do is ensure you can afford to go ahead.

If you need a mortgage to buy a property, you’ll need at least 10% of the property’s value as a deposit (though 95% mortgages are available). If you fulfil their criteria, a mortgage lender will typically loan around 4-5 times your annual salary.

Other costs to consider include the valuation fee, solicitor or conveyancer fees, stamp duty, and moving expenses. Compile an estimate of all these to determine what your budget will need to be.

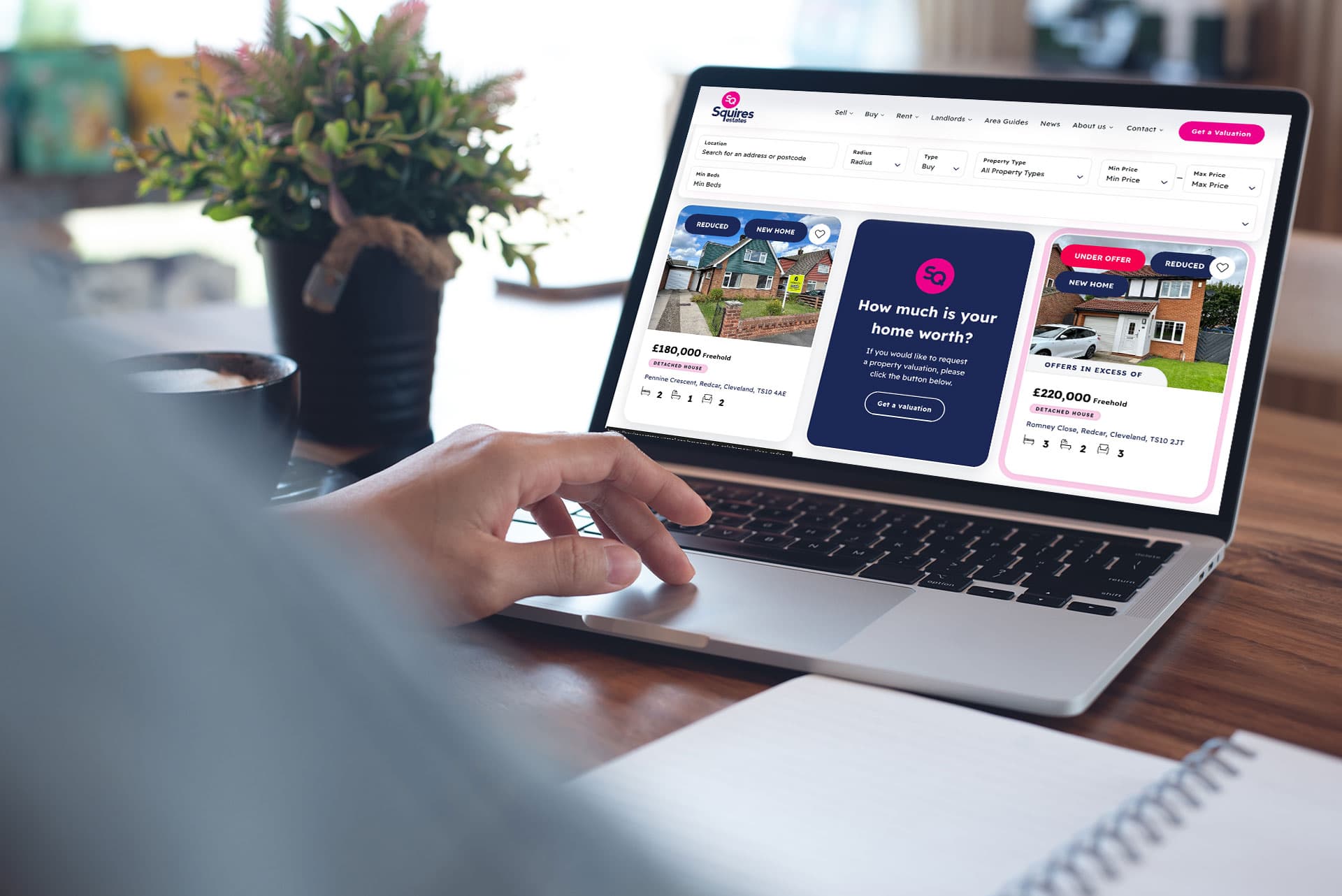

The fun part of buying a new home is the property search. This is when you pick the area you want to live in and arrange property viewings to find houses that meet your criteria.

Generally, the closer you wish to live to the centre of a town or city, the more expensive it tends to be. Consider the quality of the nearest transport links, whether they can get you to work quickly, and the zone from which you’ll be travelling.

Also consider local amenities and their accessibility, such as schools for your children, local shops, doctors, dentists and any other services you will regularly rely on.

You should decide whether you want to live in a new build or a period property (Victorian/Edwardian, etc.). New builds, of course, have never been lived in, so they are easier to move into, although they may not have the same amount of storage space as a period property or the period features.

When viewing a property, take your time to look at things like:

Once you have found a property you’d like to buy, the next challenge is to make an offer that is likely to be accepted.

Your status as a buyer is significant, as sellers often prefer individuals who are not involved in lengthy chains and can showcase their seriousness as a buyer. If you’re not a cash buyer, it’s wise to obtain a ‘mortgage in principle’ from a lender before you begin your property search, as it can help you move to the front of the queue and outpace other bidders.

The mortgage lender may ask you to go through an affordability test (although banks and building societies no longer have to request this from August 2022) to prove you can afford to pay for the mortgage over its full duration.

This involves a full credit check and necessitates that you provide detailed information regarding your income and existing financial commitments. Before exchanging contracts, you must also secure a formal offer from the mortgage lender to proceed.

Your conveyancing solicitor will handle all the legal aspects of the buying process. Meanwhile, the seller will also hire a conveyancer, and the two will serve as representatives for both parties.

Their job is to ensure everything is in order with the contract, negotiate any finer points of the sale requested by the buyer and seller, and manage the surveys and the transfer of funds.

The mortgage lender will request a property valuation by a surveyor to confirm they are happy to lend against it. However, this will not examine the complete condition of the property and land, so you will need to organise your own survey to assess this. There are four main types of surveys:

Each level has its own benefits, so do your research to determine which one is right for you.

Once you have the surveyor’s report and have taken all related action, you can proceed to exchange the contracts.

At this point, the transaction becomes legally binding for both parties and pulling out after this point could result in you losing your deposit. When you have received a formal mortgage offer, the conveyancer is happy with the searches, and the deposit is ready to be transferred, then you can arrange contracts.

You will also need to agree on a completion date before exchanging, which is typically up to 4 weeks after the contracts have been exchanged.

Let our team help you get the most out of your property.