Mill Hill Branch

7 Thornfield Parade

Holders Hill Road

Mill Hill, London

NW7 1LN

If you are considering selling your property, planning out the process will make it much easier to manage. Our property selling guide will help you achieve a fast and profitable sale.

It is important to know your current finances now that you’re looking to sell your property.

If you have a mortgage, it might be advisable to review your current lender to determine if you will face any repayment charges for breaking the agreement or transferring it to a new property, particularly if you are making an onward purchase.

There are other costs to consider too, such as agent fees, energy performance certificate costs, conveyancing costs and removal fees, which all need to be factored in. Agent and conveyancing fees are usually taken from the sale proceeds at the end of the transaction.

Before you put the property on the market, you should get a professional assessment of its current value. It ensures you are selling at a fair price that isn’t too low or too high, while also giving you a better chance of finding a buyer quickly.

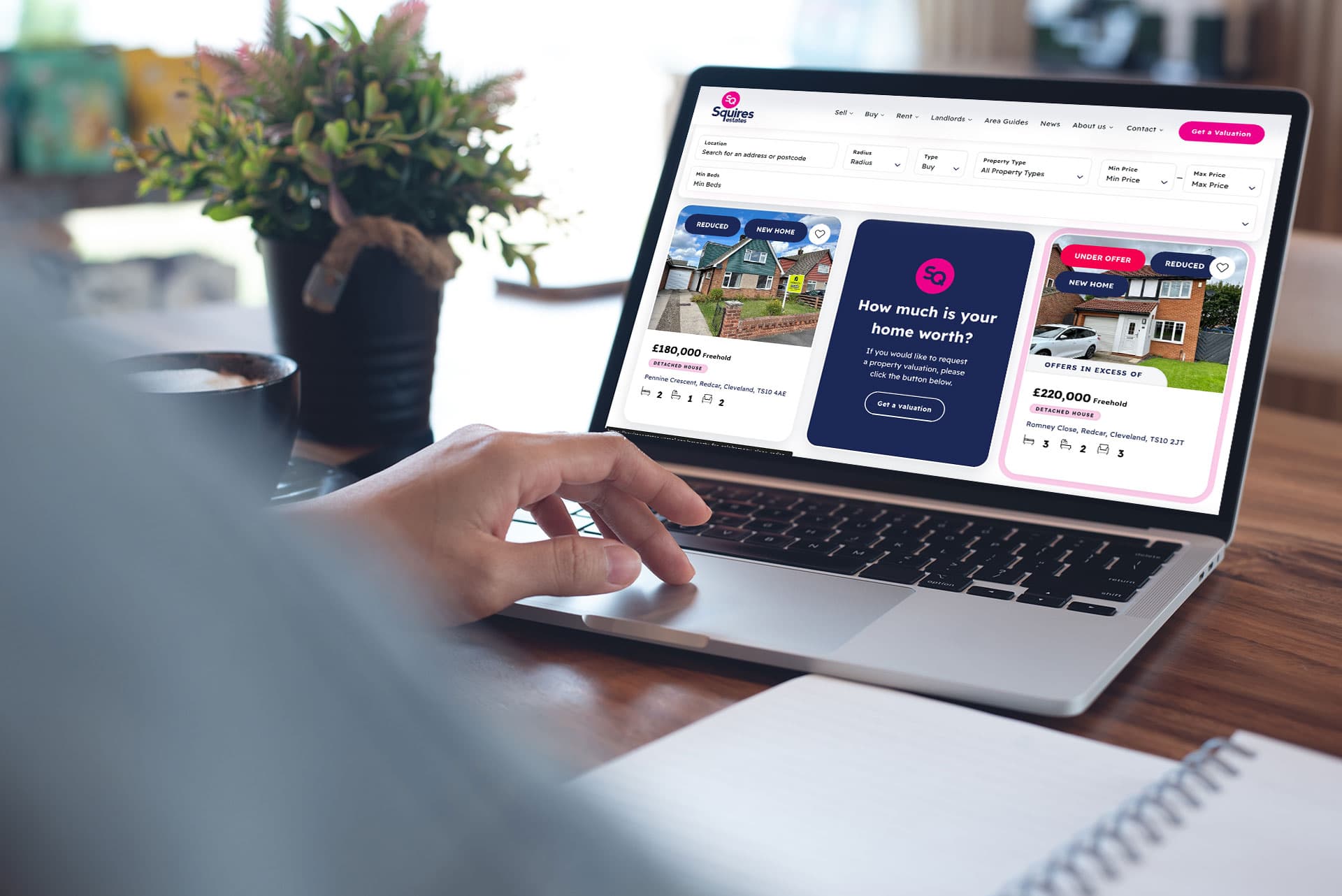

We offer a free property valuation based on the size, location, and condition of your home. Our experienced team can help you with everything you need to attract high-quality buyers, including organising floor plans, listings, and photos for marketing on the leading property portals. We can also manage property viewings and offers and communicate directly with any interested buyers, taking away a lot of the stress that comes with selling your home.

Before property viewings begin, it’s a good idea to refresh the interior and exterior of your home to make a quick and lasting impression on buyers.

Remove any clutter inside so buyers have a blank canvas to imagine themselves living there. Repair any broken fixtures, fittings, and marks on walls and ceilings. Try giving rooms an update with a fresh lick of paint (neutral colours are better) to make them more appealing to potential buyers.

Sprucing up the outside will add to your kerb appeal, so consider repainting the front door and tidying up the entrance. If you have a garden, apply the same principle as an outdoor space is often a very attractive selling point for buyers.

You will need to hire a conveyancer or property solicitor to handle the legal aspects of any potential offer you accept. It’s a good idea to hire a conveyancing solicitor before you start receiving offers, as this will keep the process running smoothly without any unnecessary delays.

The conveyancer will obtain the property deeds and mortgage details, draft the contract, respond to enquiries, negotiate with the buyer’s conveyancer, facilitate the exchange of contracts and manage the transfer of money, all the while ensuring everything is legally in order and that the buyer is keeping up their end of the deal.

Once viewings start, you will begin to receive offers. If you get more than one, the agent will consider other factors besides the money the buyer is willing to pay.

Chain-free cash buyers (such as a buy-to-let investor or someone who has already sold their home) are the safest buyers because no factors affect the source of funds. First-time buyers and home movers who have already sold and completed are also worth considering when accepting an offer on your property.

Most buyers will offer less than the asking price, so you have to decide if you want to negotiate. It can be tempting to accept a lower offer to get the process moving quickly, but you should make sure the money is enough to facilitate your move to a new property.

If it isn’t close enough to your property valuation and similar properties in the area are selling for more, you may want to hold out for a better offer. You should also consider how quickly you need to sell and the buyer’s situation as part of your decision. Your estate agent will be able to help here and offer advice based on similar situations they have experienced with other clients.

Once your current property is under offer, you should start working with estate agents to search for a new home. When choosing your next property, you have two options: either rent out a property or, if the right property is on the market, continue with an onward purchase.

If you find a home that has attracted a lot of interest, having a property currently under offer puts you in a strong position, especially in a competitive market. It also means you have a better chance of securing a property you have fallen in love with, rather than losing it to someone else who is ahead of you in the chain.

When you exchange contracts, the transaction becomes legally binding. This means it cannot fall through at this stage and must proceed. The deposit is paid via your conveyancer, and if you are moving to a new property, make sure you have buildings insurance in place from this point onwards.

Completion usually happens around 7-28 days after the exchange of contracts, when the property deeds are handed over and you receive the remaining funds. Try to complete the purchase of your new home on the same day as completing the sale, so you can move your belongings across without any delays.

Let our team help you get the most out of your property.